The Evolving Cyber Insurance Market

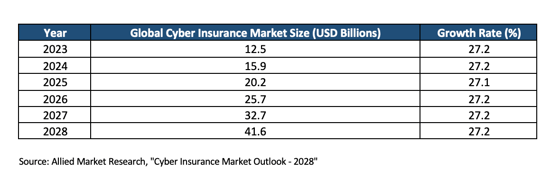

The global cyber insurance market has surpassed earlier projections, reaching $35 billion in 2025, reflecting its critical role in risk management strategies. This surge isn't just a number – it's a response to the real and present danger that cyber threats pose to businesses of all sizes.

Cyberattacks now occur every 39 seconds on average, a stark increase from previous years. Despite this, a significant coverage gap persists, with 87% of companies still lacking adequate cyber insurance– a major risk in today's threat landscape. The average cost of a data breach has escalated to $5.2 million, a 25% increase over the past five years.

|

Key Trends Shaping Cyber Insurance

1. Stricter Underwriting Requirements

Insurers now demand comprehensive security protocols before offering coverage. Multi-factor authentication (MFA), advanced endpoint protection, and detailed incident response plans are prerequisites.

2. The Rise of Ransomware-as-a-Service (RaaS)

RaaS platforms have democratized cybercrime, lowering the barrier to entry for malicious actors. Organizations must implement robust backup systems and regularly test their incident response plans to mitigate these risks.

3. AI-Driven Attacks and Defense

Advanced AI-powered security solutions can now detect and neutralize sophisticated threats that bypass traditional measures. AI-driven extended detection and response (XDR) systems are becoming essential in identifying complex phishing campaigns and advanced persistent threats.

4. Supply Chain Vulnerabilities

Cybercriminals increasingly target supply chain providers. Comprehensive security solutions must protect the entire digital ecosystem, from core operations to the farthest reaches of the supply chain.

Navigating Challenges in Cyber Insurance

You might be wondering, "How can I possibly keep up with these evolving threats?"

That's where we come in. Our work with over 20,000 customers across diverse sectors has given us unique insights into industry-specific cyber-insurance needs. Whether you're in healthcare, finance, or education, we understand the nuanced challenges you face.

- Rising Premiums and Coverage Limitations: We've seen premiums surge due to increased claims frequency. Our risk assessment services can help you implement measures that may lead to more favorable terms.

- Complex Application Processes: The days of simple applications are over. We can guide you through the rigorous documentation requirements, ensuring you put your best foot forward.

- Evolving Coverage Definitions: With the lack of standardization in policy language, understanding your coverage can be daunting. Our experts can help decipher policy terms, ensuring you know exactly what you're getting.

How New Era Technology Empowers Your Cyber Insurance Strategy

With over 80 offices worldwide, we combine global expertise with local understanding. Our team in your area is familiar with regional cybersecurity regulations and insurance market trends.

- Enhance Your Security Posture: Our SecureBlu service improves your security stance and minimizes risk with a full range of advisory and managed security services.

- Streamline Insurance Applications: We can help you navigate the complex application process, presenting your security measures in the best light.

- Ensure Continuous Compliance: Our ongoing monitoring and management services help maintain compliance with policy requirements, reducing the risk of claim denials.

- Provide Incident Response Support: In the event of a cyber incident, we can be by your side, managing the response and documentation crucial for claims.

- Offer Comprehensive Solutions: From CloudBlu for flexible cloud deployment to Professional Services for technology implementation, we provide end-to-end solutions to bolster your cybersecurity posture.

Cyber insurance is an important component of a comprehensive risk management strategy, but it should not be viewed as the primary defense against cyber threats. It serves as a safety net, providing financial protection in the event of a breach. However, the primary focus for any organization should be on building and maintaining a robust security infrastructure. This proactive approach to cybersecurity is essential in preventing incidents and mitigating risks before they escalate to the point of requiring an insurance claim.

Regulatory Changes

Recent federal legislation has introduced stricter reporting requirements for cyber incidents and mandated minimum cybersecurity standards for critical infrastructure sectors. Organizations must stay informed about these evolving regulations to maintain compliance and insurability.

Action Items for Improved Cyber Insurance Readiness

- Conduct a comprehensive cybersecurity assessment

- Implement and regularly update an incident response plan

- Invest in employee cybersecurity training

- Evaluate and enhance third-party risk management

- Stay informed about emerging cyber threats and insurance trends

Take Your Next Step With New Era Technology Security Solutions >